Medicare Advantage and the Nearing Annual Election Period

Introduction

Navigating Medicare can feel like trying to read a map written in a foreign language. With complex terms and numerous plan options, it’s no wonder many people feel overwhelmed. As the Annual Election Period (AEP) approaches, it’s crucial to understand Medicare Advantage plans and how this period impacts your health coverage choices. In this guide, we’ll break down what you need to know about Medicare Advantage and how to make the most of the upcoming AEP.

What is Medicare Advantage?

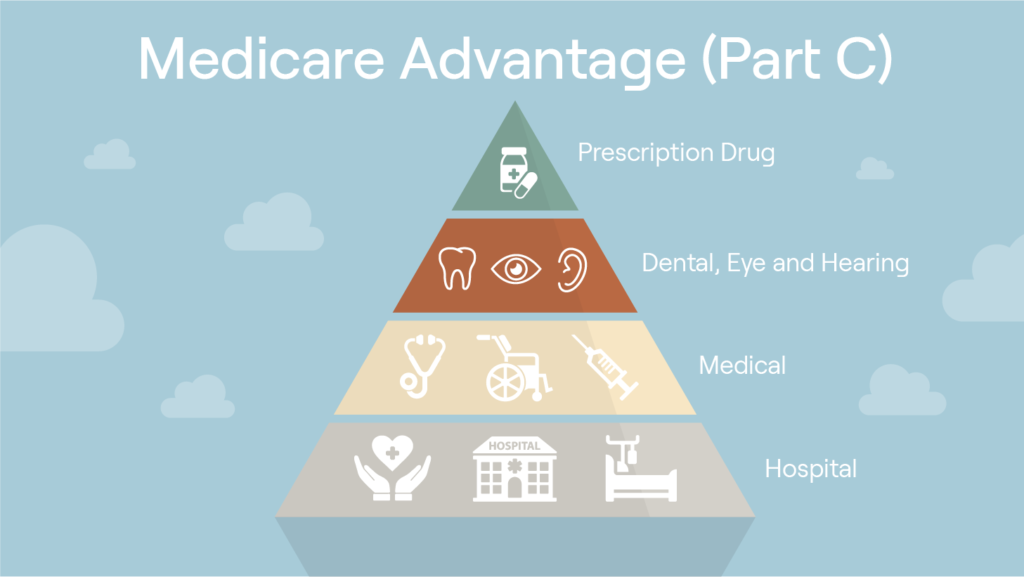

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare (Part A and Part B). These plans are offered by private insurance companies approved by Medicare. Medicare Advantage plans include all the coverage of Part A (hospital insurance) and Part B (medical insurance), and often offer additional benefits such as vision, dental, and hearing coverage.

Key Features of Medicare Advantage Plans

- Comprehensive Coverage: Medicare Advantage plans cover everything that Original Medicare covers, plus extra benefits.

- Network Restrictions: Most Medicare Advantage plans require you to use a network of doctors and hospitals.

- Out-of-Pocket Limits: Medicare Advantage plans have a maximum out-of-pocket limit, which can protect you from high medical costs.

The Annual Election Period (AEP)

The Annual Election Period (AEP) runs from October 15 to December 7 each year. During this time, you can make changes to your Medicare Advantage plan or switch between different plans. Here’s what you need to know:

- Open Enrollment Window: The AEP is your chance to review your current plan and make changes if needed. It’s the time to evaluate whether your current plan still meets your needs or if you should switch to a different plan.

- Plan Comparison: During AEP, you can compare plans based on premiums, coverage, and additional benefits.

Why is AEP Important?

The decisions made during AEP can significantly impact your health coverage for the coming year. With so many changes in healthcare policies and plan options, it’s essential to take the time to review and understand your options.

Steps to Take Before AEP

- Review Your Current Plan: Look at how well your current plan has served you over the past year. Have your medical needs changed? Are you satisfied with the coverage and costs?

- Check Upcoming Changes: Medicare Advantage plans can change their benefits, costs, and network each year. Be sure to review any notifications you receive from your plan.

- Research New Plans: Use the Medicare Plan Finder tool or contact a licensed insurance agent to explore available plans and their details.

How to Compare Medicare Advantage Plans

- Coverage Needs: Assess what additional coverage you need. Do you need vision, dental, or hearing coverage?

- Cost: Compare the monthly premiums, deductibles, and out-of-pocket costs.

- Provider Network: Ensure that your preferred doctors and hospitals are in the plan’s network.

- Star Ratings: Medicare assigns star ratings to plans based on quality and performance. Higher ratings generally indicate better plan performance.

Common Mistakes to Avoid During AEP

- Not Reviewing Changes: Don’t assume your current plan will automatically meet your needs in the upcoming year. Always review any changes.

- Ignoring New Plan Benefits: New plans might offer benefits that could better suit your needs. Don’t overlook these options.

- Missing Deadlines: Ensure you make all changes within the AEP timeframe to avoid losing coverage or facing penalties.

Resources for Assistance

- Medicare.gov: The official Medicare website provides a wealth of information and tools for comparing plans.

- State Health Insurance Assistance Programs (SHIPs): SHIPs offer free, personalized help with Medicare choices.

- Licensed Insurance Agents: They can provide guidance and help you understand different plan options.

How to Enroll in a New Medicare Advantage Plan

- Gather Information: Have your Medicare card and personal information handy.

- Choose Your Plan: Based on your research, select a plan that meets your needs.

- Apply: You can enroll online through the Medicare website, by phone, or through a licensed insurance agent.

- Confirm Enrollment: After applying, you’ll receive a confirmation letter. Make sure to review it carefully.

What Happens After AEP?

Once AEP ends, any changes you made to your Medicare Advantage plan will take effect on January 1 of the following year. You’ll receive a new membership card and information about your coverage. Be sure to review these materials to ensure everything is correct.

Conclusion

As the Annual Election Period approaches, taking the time to understand Medicare Advantage and carefully review your options can make a significant difference in your healthcare experience. By preparing in advance and making informed decisions, you can ensure you have the coverage that best fits your needs and preferences.

FAQs

1. What is the difference between Medicare Advantage and Original Medicare? Medicare Advantage includes all benefits of Original Medicare plus extra coverage like vision and dental. Original Medicare is directly provided by the government and does not typically include additional benefits.

2. Can I switch Medicare Advantage plans outside of AEP? No, you can only make changes to your Medicare Advantage plan during AEP, unless you qualify for a Special Enrollment Period due to certain life events.

3. How do I find out if my doctor is in a Medicare Advantage plan’s network? You can check the plan’s provider directory on its website or call customer service for assistance.

4. What should I do if I miss the AEP? If you miss the AEP, you generally have to wait until the next enrollment period unless you qualify for a Special Enrollment Period due to specific circumstances.

5. Are there any penalties for not enrolling in a Medicare Advantage plan during AEP? There are no penalties for not enrolling in a Medicare Advantage plan, but you may face a late enrollment penalty if you delay enrolling in Medicare Part B, which is required to join a Medicare Advantage plan.